Bitcoin’s Utility as a Store of Value: Explaining the HODL Phenomenon

Exploring why the majority of Bitcoin remains unspent, and how this impacts adoption of the Lightning Network and Bitcoin’s role as a store of value.

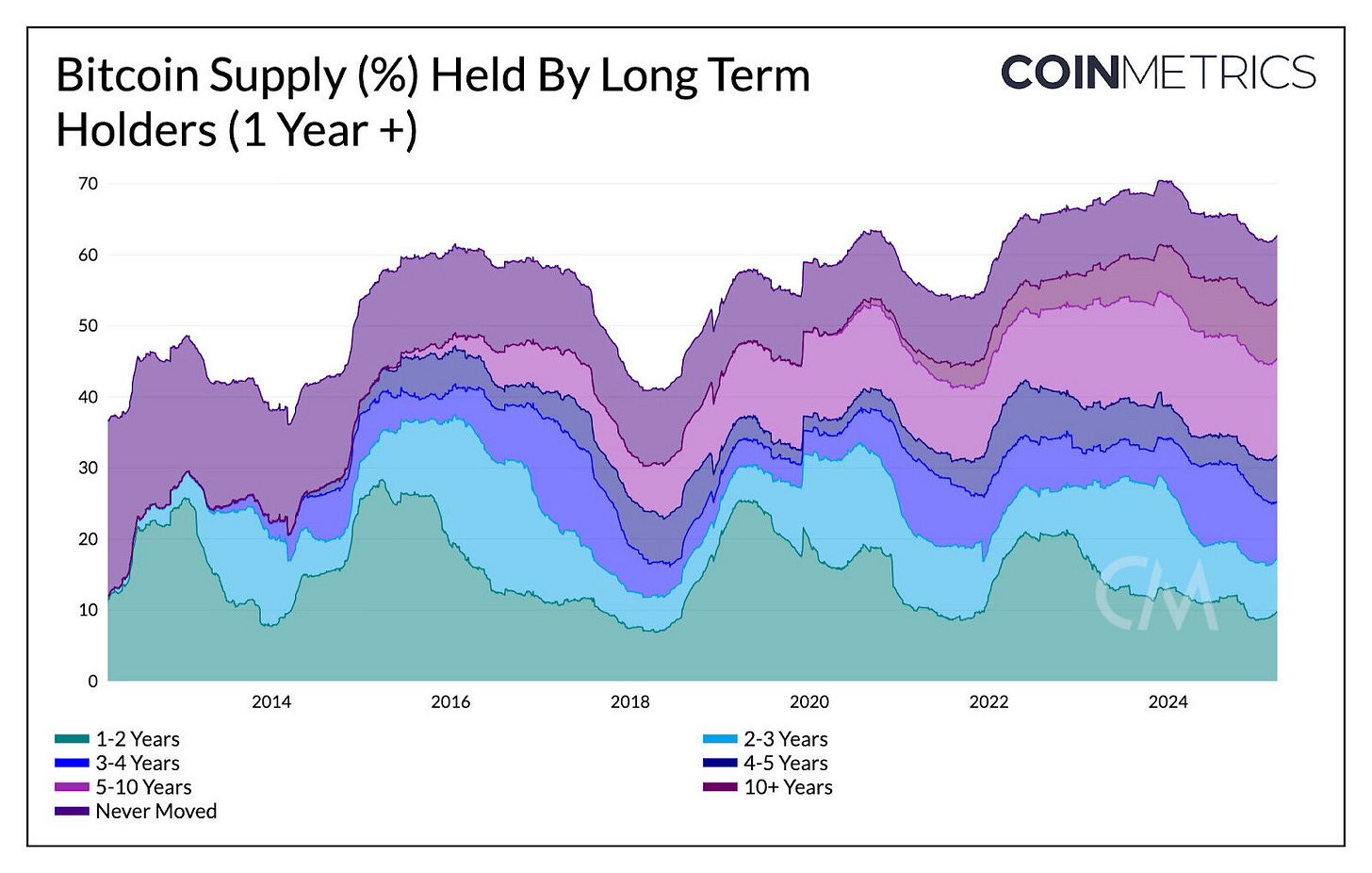

Recent data indicates that approximately 63% of the total Bitcoin supply has remained unmoved for over a year, highlighting a strong inclination among holders to retain their assets.

Spending vs. Saving: The Incentive Structure

Here are some key points that underscore the appeal to holding BTC

Fiat Currency Dynamics: Fiat currencies are subject to inflation, which can erode purchasing power over time, incentivizing spending rather than saving.

Bitcoin's Deflationary Nature: Bitcoin's deflationary design encourages holding, as its value is expected to increase over time, making spending less appealing.

Behavioral Economics: The tendency to hold Bitcoin aligns with behavioral economic principles, where individuals prefer to retain assets that are expected to appreciate.

Bitcoin is fundamentally appealing to hold because of its fixed supply and deflationary nature. Unlike fiat currencies, which can be printed in unlimited quantities and are subject to inflation, Bitcoin has a hard cap of 21 million coins. This scarcity makes it similar to digital gold—a store of value that becomes more attractive over time as demand increases and supply remains limited.

Additionally, Bitcoin operates independently of central banks or political influence, offering holders a hedge against currency debasement and geopolitical uncertainty. Its track record of long-term appreciation further reinforces the holding narrative.

For many, the choice is simple: why spend an asset that’s likely to be worth more tomorrow, when you can spend fiat that will likely lose purchasing power? This would also be a reasonable explanation as to why there has been low demand in the lightning network.

Follow us on LinkedIn to receive push notifications on our latest posts.