BlackRock Expands IBIT ETF Into $150 Billion Model Portfolio Universe

This article explores how BlackRock’s integration of its iShares Bitcoin Trust ETF (IBIT) into its $150 billion model portfolio universe could drive significant new demand, accelerating adoption.

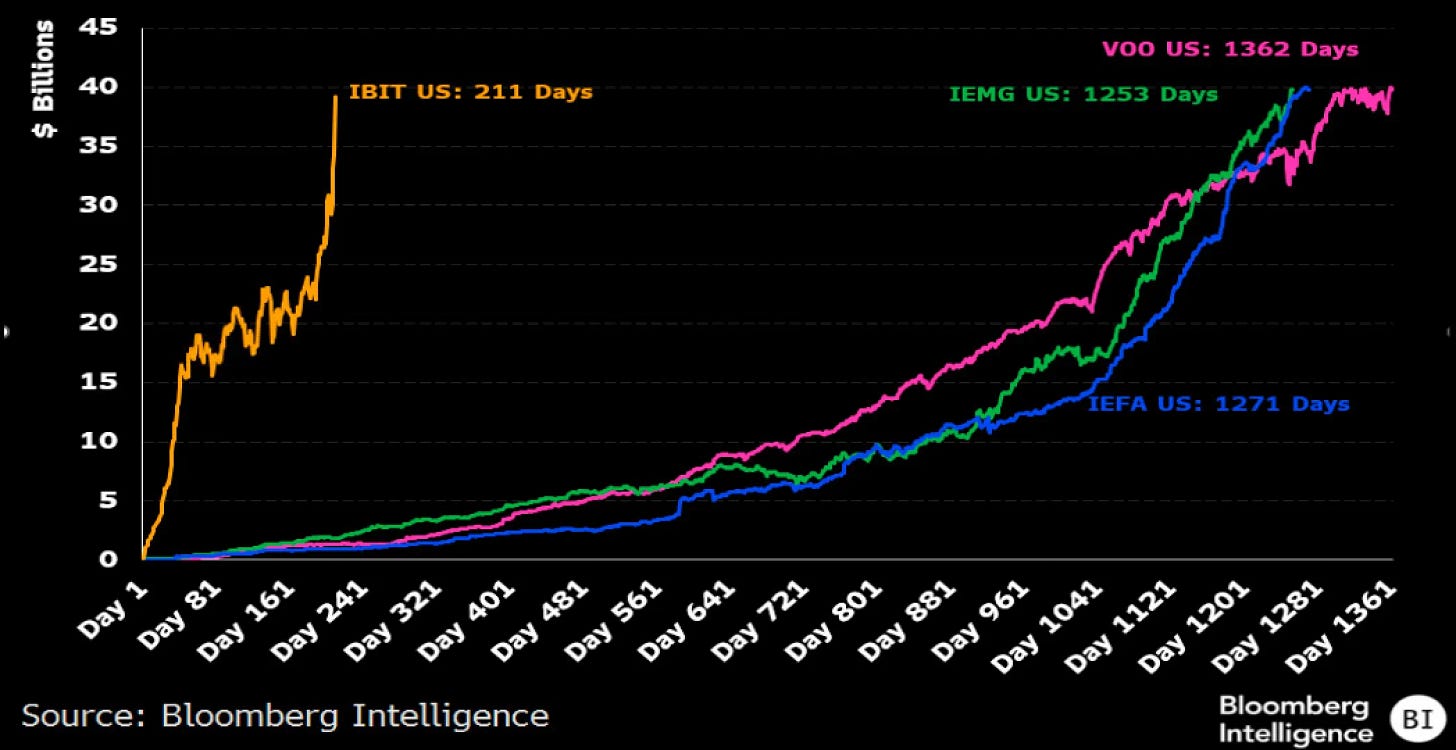

BlackRock’s iShares Bitcoin Trust ETF (IBIT) has already set records in the ETF space, amassing over $50 billion in assets under management (AUM) in just over a year. Now, with its inclusion in BlackRock’s $150 billion model portfolio universe, IBIT is positioned for even greater growth.

New Institutional Demand Could Drive Billions in Additional Inflows

BlackRock’s model portfolios are widely used by financial advisors, RIAs (Registered Investment Advisors), and institutional wealth managers to construct diversified investment strategies. These advisors typically follow model allocations, meaning that if Bitcoin is included in recommended portfolios, a percentage of new capital will automatically flow into IBIT.

Potential Impact: If only 1% of the $150 billion allocated to model portfolios is directed toward IBIT, that’s $1.5 billion in additional inflows—and that’s just from initial adoption.

If Bitcoin allocations were to increase over time (to 2%-5%, like gold allocations in some portfolios), we could potentially see $3-$7.5 billion in inflows from this move alone.

IBIT’s Competitive Advantage Over Other Bitcoin ETFs

IBIT is already the largest spot Bitcoin ETF by AUM, surpassing competitors like Fidelity’s FBTC and Ark’s ARKB. Its deep liquidity, institutional credibility, and BlackRock’s massive distribution network give it a unique edge:

Scale Benefits: As AUM increases, trading volumes grow, spreads tighten, and costs decrease, making IBIT even more attractive.

BlackRock’s Influence: With trillions in assets and relationships with institutional clients, pension funds, and sovereign wealth funds, IBIT could become the default Bitcoin ETF for large investors.

Conclusion: Bitcoin poised to become more mainstream

With its inclusion in BlackRock’s model portfolios, Bitcoin is well-positioned for continued growth, new capital inflows, and increased institutional adoption. If Bitcoin allocations rise in mainstream portfolios, it would not be surprising to see IBIT surpass $100 billion in AUM in the coming years, reinforcing BlackRock’s dominance in both traditional and digital asset markets.

Follow us on LinkedIn to receive push notifications on our latest posts.