U.S. SEC Launches Crypto Task Force Under Trump Administration

In this issue, we discuss the launch of a dedicated crypto task force to establish clear regulations for digital assets, marking a major policy shift under the Trump administration.

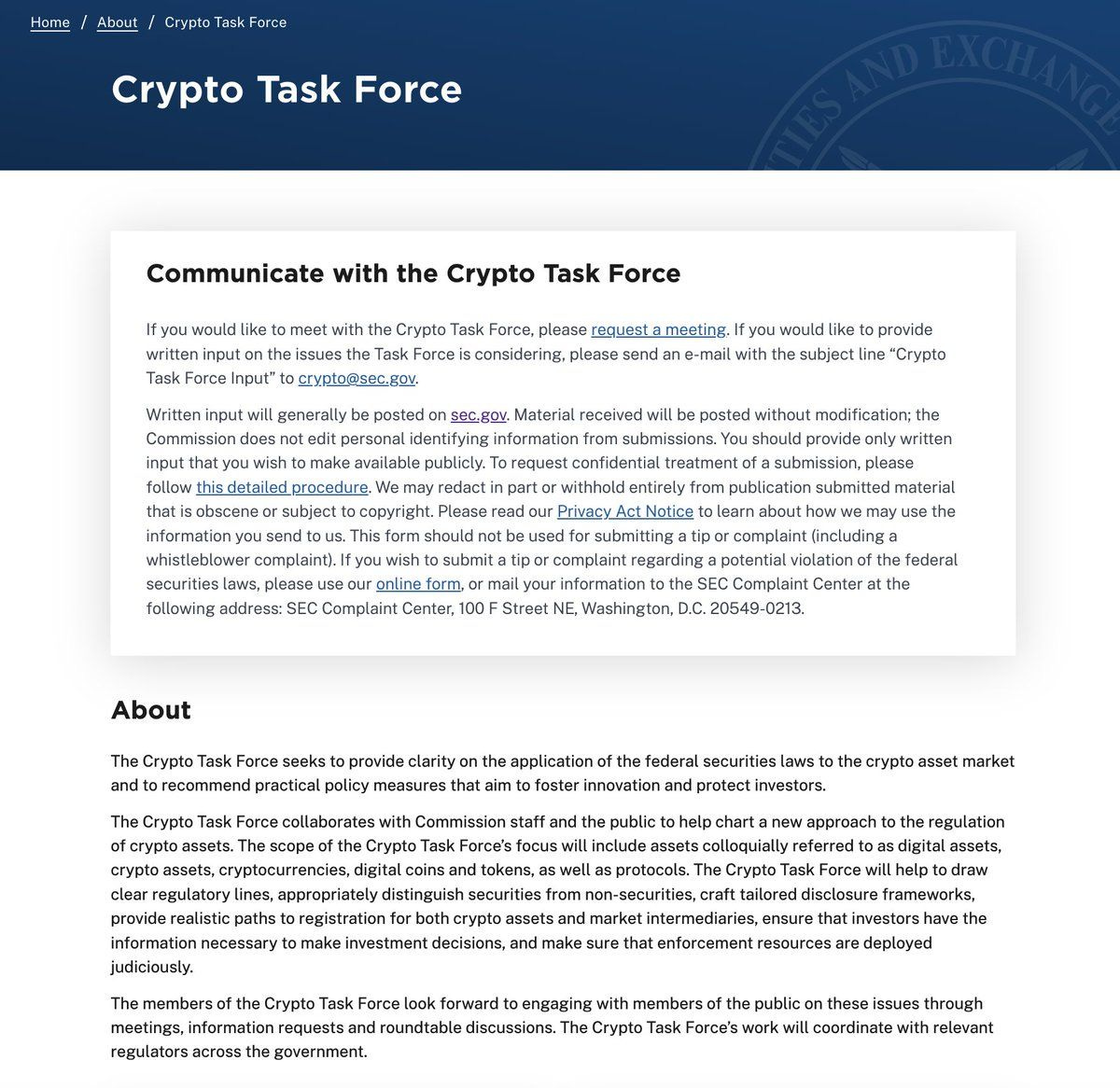

On January 21, 2025, the U.S. Securities and Exchange Commission (SEC) announced the formation of a crypto task force, marking a pivotal shift in U.S. regulatory policy under the Trump administration. Acting Chairman Mark T. Uyeda, alongside Commissioner Hester Peirce, is leading this initiative to establish a structured, transparent framework for digital assets.

For many years, the crypto industry has faced regulatory uncertainty, leading to legal battles, halted innovation, and companies relocating to other countries. The SEC’s new approach moves away from regulation by enforcement and toward a system that allows businesses to operate with clear compliance oriented pathways instead.

Key Objectives of the SEC Crypto Task Force:

Creating transparent regulatory guidelines – Establishing clear rules for digital asset firms, ensuring they can operate legally without arbitrary enforcement actions.

Develop practical compliance pathways – Provide structured options for companies to register and comply with SEC rules, rather than facing penalties without prior guidance.

Enhancing investor protections without stifling innovation – Introducing realistic disclosure requirements that support industry growth while safeguarding consumers.

Improve engagement with the crypto industry – Fostering direct communication between regulators and blockchain firms to ensure regulations align with real-world applications.

Why This Matters

Under the previous administration, the SEC—led by Gary Gensler—adopted an aggressive enforcement strategy, suing multiple crypto firms without offering clear compliance guidelines. This approach pushed innovation offshore and discouraged institutional adoption in the U.S.

Now, with Uyeda and Peirce leading the initiative, the SEC is expected to shift its stance to prioritize clarity over enforcement. This new regulatory framework is expected to:

Encourage blockchain innovation by eliminating uncertainty that has hindered startups and established firms alike.

Attract institutional investment as a structured regulatory environment fosters confidence among hedge funds, banks, and asset managers.

Align U.S. policy with global regulatory developments, such as the EU’s MiCA framework and Hong Kong’s pro-crypto stance.

Market Reaction

The market has responded positively to this regulatory shift. Following the announcement, Bitcoin and other major cryptocurrencies saw an uptick, as investors welcomed the prospect of a more predictable regulatory landscape. Industry leaders have also expressed optimism, viewing this move as a long-overdue step toward legitimizing digital assets in the U.S.

The new task force represents a major turning point for digital asset regulation, signaling a constructive approach that supports innovation while ensuring compliance. The industry is entering a new era—one where regulatory uncertainty no longer stifles progress.

Follow us on LinkedIn to receive push notifications on our latest posts.